Choosing the Right Legal Structure for Your Business: Considerations for Start-up Businesses

Choosing a legal structure for your business can be confusing. The best way to choose a legal structure for your business is to take a look at the big picture, traveling into the future and asking yourself what do you really want to accomplish from the moment you plan your business to the moment you exit it.

Here you have a few factors to take into consideration while choosing the best legal structure for you:

- Do I want or will I have partners?

- Will I be a local business or operate in more than one State?

- Do I want to grow globally?

- Will I ever consider becoming or offering a franchise?

- Will my business be full time or part time?

- Do I have assets to protect from possible liability?

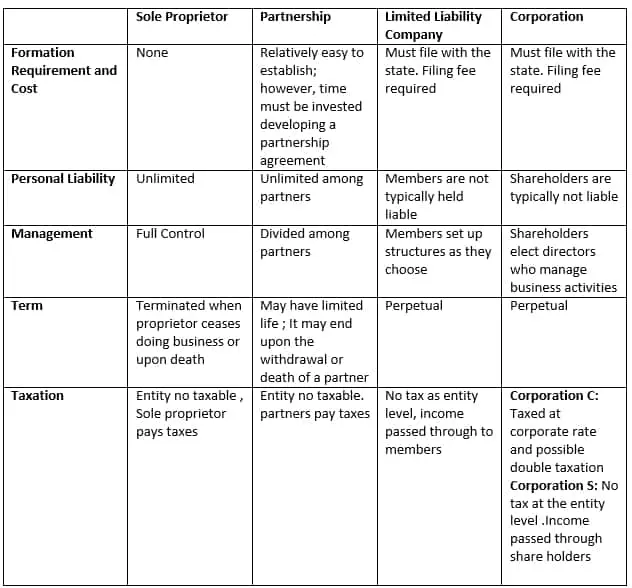

So in asking all of these questions, the greater question remains – Which tax structure do I want to use? Learning about the differences and similarities, advantages and disadvantages of each legal structures is one of the first steps to be taken by an entrepreneur. So which one is good for you? Consider the following:

Sole proprietor

These firms are owned by a person, usually the individual that has day-to-day responsibilities for running the business. Sole proprietors assume complete responsibility for any of the liabilities. In the eyes of the public and the law, you are one in the same with the business.

General Partnership

In the eyes of the public and the law as with sole proprietor the business and the owners (2 or more) are the same. All income of a partnership must be reported as distributed to the partners who will be taxed on it through their individual return.

Corporation

The standard corporation is a separate legal entity owned by shareholders. You file your corporation with the state for a fee. The corporate structure limits each owner’s (shareholder’s) personal liability for the corporation’s business debts to the amount invested in the company by the shareholders.

Limited Liability Company

The limited liability company offers an alternative to corporations and partnerships by combining the corporate advantage of limited liability protection with the partnership advantage of pass-through taxation. You file a limited liability with the state paying the related filing fees.

See comparison table below:

For more information please contact the Florida SBDC at Hillsborough County.

Source: www.themoneyalert.com/businesstypesofownership.html

[blog_list thumb=”medium” showposts=”1″ post_content=”full” category_in=”337″ disable=”image,meta,more”]