Credit card changes shifting responsibilities

As consumers we have been receiving our new credit and debit cards with the ‘chip.’ Perhaps you’ve read that this makes your card safer. This is all great for us as consumers, but what does it mean to retailers?

EMV, or Europay MasterCard Visa, is a newer technology for U.S. consumers that aims to reduce the amount of counterfeit cards and transactions. This technology has been in place in Europe and Canada for a number of years and both regions report their fraud and counterfeit cases have substantially been reduced. Many use the term chip instead of EMV to refer to the card.

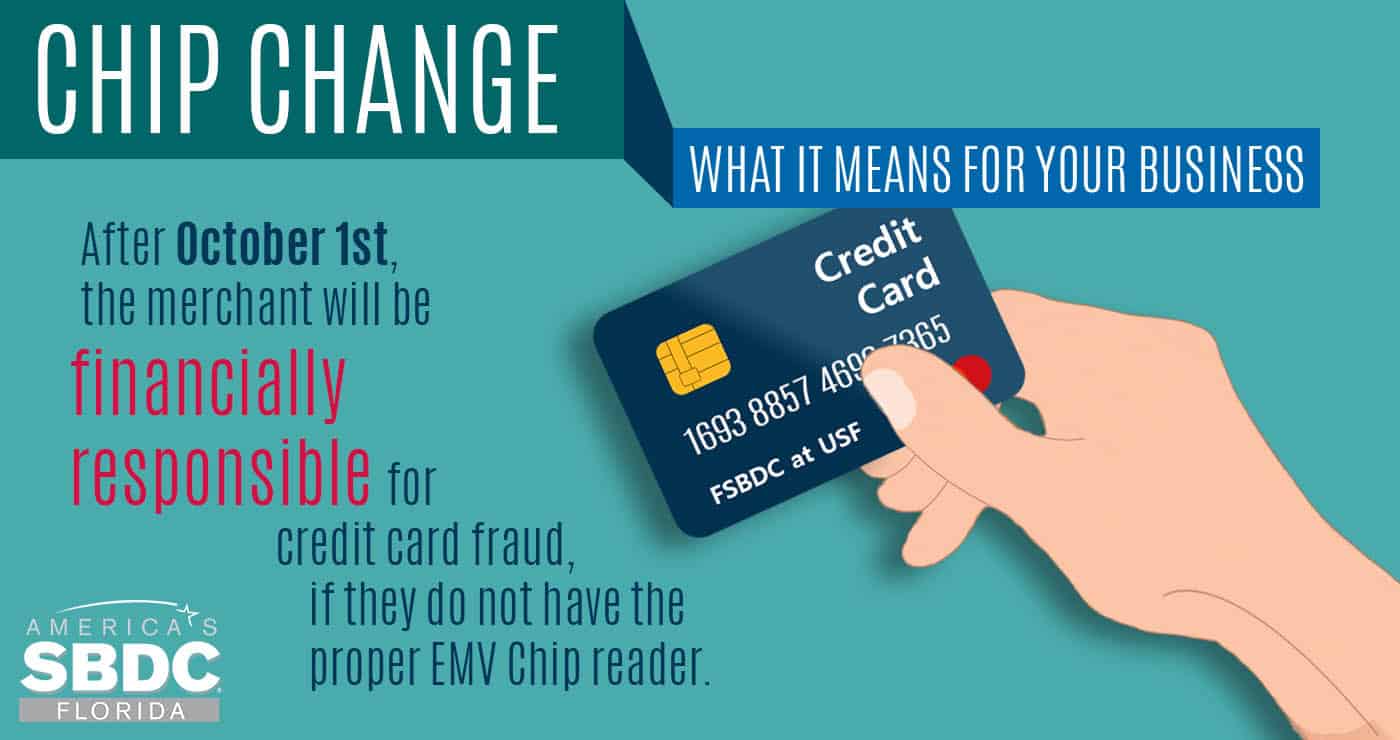

Now that the October 1, 2015, change over date is around the corner, U.S. retailers that accept credit cards on countertop stations, cash registers or mobile point of sale (POS) units have to update or upgrade their systems.

This new card is not swiped but rather inserted into the POS, and it takes several seconds to authenticate before the transaction is complete. Many POS providers have equipped their clients with EMV enabled equipment, but perhaps the software update has not been made. If you are not sure, check with your provider to make sure you are ready to go on October 1.

It will not be the end of the world for retailers that do not meet the October 1 deadline. However, should a counterfeit card be used, the liability now rests on the retailer. This liability shift is the biggest change with the introduction of this technology. The change will affect brick and mortar (2015), mobile businesses (2016) and gas stations (2017). Online retailers do not use a physical POS and no change is expected for this type of business, in the near future.

Card users will have the option to use the card with or without a pin. Requiring the use of a pin will increase the security of the card, ultimately better protecting the consumer. Consumers can contact their card issuing company and request the additional feature of using a pin or requiring a signature for all transactions.

The magnetic stripe is not going away any time soon. However, for POS businesses ready to take the chip, card swiping will not process the transaction. This is an additional safety feature for the consumer and for the retailer. Consumer chip cards will not be accessible to copy like magnetic only cards are, and retailers will be able to reduce their liability by using updated POS systems that will prevent swiped transactions of chip-enabled cards.

Contact your POS provider for support and evaluate how the cost of updating your POS compares to your potential liability. Peace of mind, reduced liability, and business protection can be priceless.

[blog_list thumb=”medium” showposts=”1″ post_content=”full” category_in=”324″ disable=”image,meta,more”]