Show Me the Money!

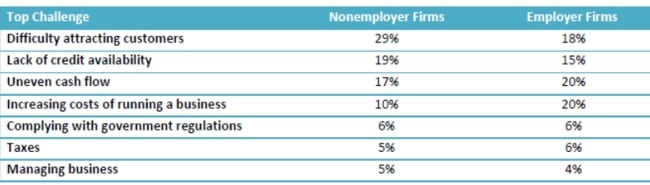

The 2014 Federal Reserve Small Business Credit Survey reports that small businesses rank, “difficulty attracting new customers” as their top business challenge.

This statistic helps explain why many of my clients have the same request so often. Show me the money! They want to talk about marketing, advertising, promotions, social media, and any other strategy they think will boost sales. Imagine their surprise when I respond with, “Show me the money!” I’m not asking for payment, because Florida SBDC Network consulting services are no-cost and confidential.

I need to see the company financial statements.

The challenge is shifting the conversation from sales to profitability. Many clients put their efforts behind a product/service that generates the most sales/revenue without regard for its contribution margin. These customers may be ignoring products/services that will generate greater profits.

I’ve had clients show larger profits from less sales. How is that possible? By adjusting their product mix and marketing to focus on higher margin products and services. However, I cannot diagnose this problem without a thorough analysis of a company’s financial statements, which is hard for some business owners to share.

Many times the reason a company is not profitable has nothing to do with sales volume. How can that be? Have you ever heard the term “a penny saved is a penny earned?” Some businesses generate a lot of sales but have ignored their expenses. They are spending money faster than they are making it.

Complacent business owners tend to pay too much for raw materials, have bloated inventories, wages as a percentage of sales that exceed industry norms, or any number of other expenses that have eaten away at their bottom line. This type of situation cannot be diagnosed without a thorough review of a company’s financial statements.

A company can add thousands in net profit to the bottom line without a dollar more in sales by aggressively managing their expenses.

Then there’s the client that replies, “I don’t have financial statements.” Really? How do they monitor the financial health of their company? This is akin to playing nine innings of baseball without running the scoreboard and declaring themselves the victor. The manager can easily argue his/her team scored a lot of runs and they deserve to win. The reality is that the coach doesn’t know how many runs his team tallied, let alone how many runs were scored by the opponent. The coach also doesn’t know what players are contributing and which ones are laggards.

The truth is that a baseball manager cannot make the adjustments necessary during the game if he doesn’t know the score. This is as true in baseball as it is in business. If your business doesn’t keep timely, accurate financial statements, now is the time to start. Once you know the score you can implement the changes needed to win the game.

When you’re ready to take your business to the next level, show me the money!

[blog_list thumb=”medium” showposts=”1″ post_content=”full” category_in=”328″ disable=”image,meta,more”]