Top SBA Lenders in 2014

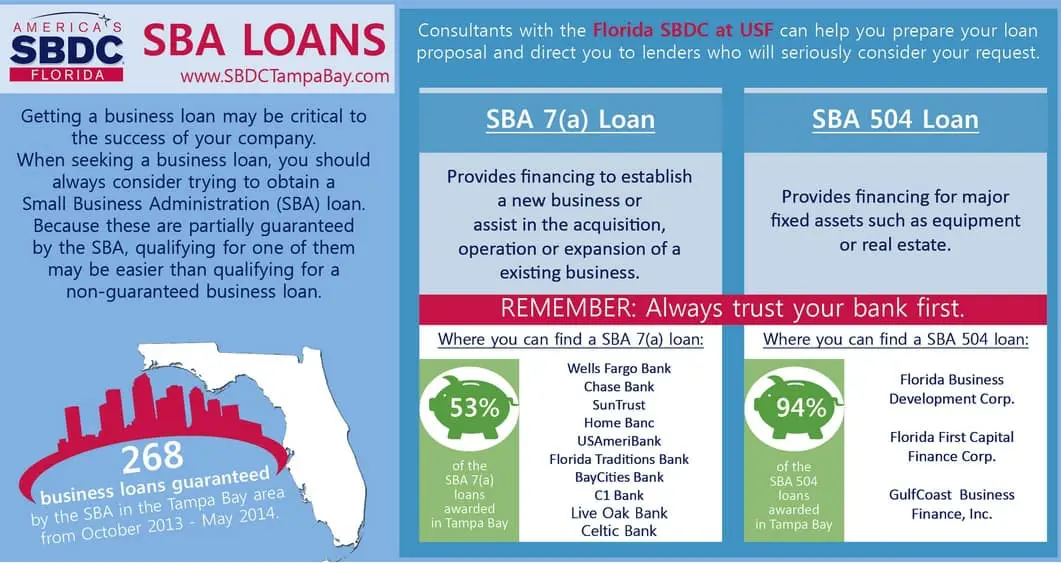

Getting a business loan may be critical to the success of your company. If your company needs one, you may be confused about where to go. According to Jim Parrish, Growth Acceleration Consultant with the Florida SBDC at USF, “When seeking a business loan for your company, you should always consider trying to obtain an SBA (Small Business Administration) loan. These loans are partially guaranteed by the SBA. Therefore, qualifying for one of them may be easier than qualifying for a non-guaranteed business loan.”

So you have heard that the SBA 7(a) loan program provides financing to establish a new business or to assist in the acquisition, operation, or expansion of an existing business and the SBA 504 Loan program provides financing for major fixed assets such as equipment or real estate. But you don’t know which banks actually do them.

Parrish suggests that entrepreneurs should, “always try your bank first. They should already know about your business and you. Ask them if they do SBA lending and if they can help you?”

If they can’t help you, try one of the lenders on the list below. They are the most active SBA lenders in the Tampa Bay area.

From October 2013 through May 2014, there were 268 business loans guaranteed by the SBA through its 7(a) loan guarantee program in the Tampa Bay area. This was a slight increase (3%) from the 260 SBA loans closed during the same period in the prior SBA year, which operates October through September.

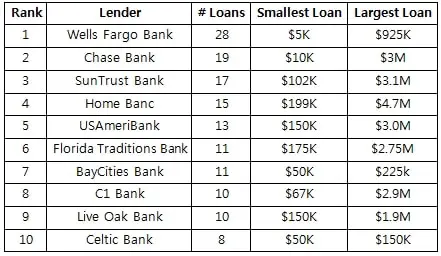

The most active SBA 7(a) lenders in the Tampa Bay area accounted for 53 percent of the SBA 7(a) loans awarded in Tampa Bay over the last eight months. They are:

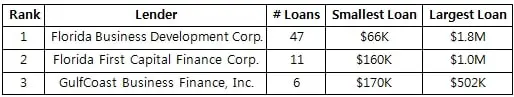

The most active SBA 504 lenders in the Tampa Bay area accounted for 94 percent of the SBA 504 loans awarded in Tampa Bay over the last eight months. They are:

According to Parrish, “Remember the consultants with the Florida SBDC at the University of South Florida can help you prepare your loan proposal and direct you to lenders who will seriously consider your request because they want to make loans.”

[blog_list thumb=”medium” showposts=”1″ post_content=”full” category_in=”317″ disable=”image,meta,more”]