Why just breakeven on financial projections?

One of the major challenges to a small business is funding. One way to evaluate your business is to create realistic financial projections. For the first year projections, do the following: Increase the projected expenses by 30 percent, then reduce the projected revenue by 50 percent.

If the funding in the business can support these potentially dire consequences, then move forward. When starting a business there are always 15 to 20 percent higher costs than expected once the business is up and running.

Also, most entrepreneurs tend to be overly optimistic on their projected sales/revenue by 30-50 percent. By planning for these variables, you just might make it through your first year. Keep this in mind when going to investors or asking for a bank loan.

A client of mine was expanding their manufacturing operations to a second location and was considering asking the bank for the projected construction and build out costs of $1 million. I asked the business owner, if the first $1 million location went over budget. He said, yes, it had by 20 percent. So I said it potentially could cost $1.2 million if the projections were not accurate? He concurred. If you take a $1 million loan from a bank and then three months later come back and say, “Well, it actually was 20 percent more and I need another loan,” you might not get it. Many banks would object and lose confidence in you as a business owner.

The solution?

Ask for 30 percent more if you can get it. If the excess funds are not needed, they can be returned to the bank, used to pay down debt, or just service the bank loan, but it just may save you should your projections not be as accurate as you think.

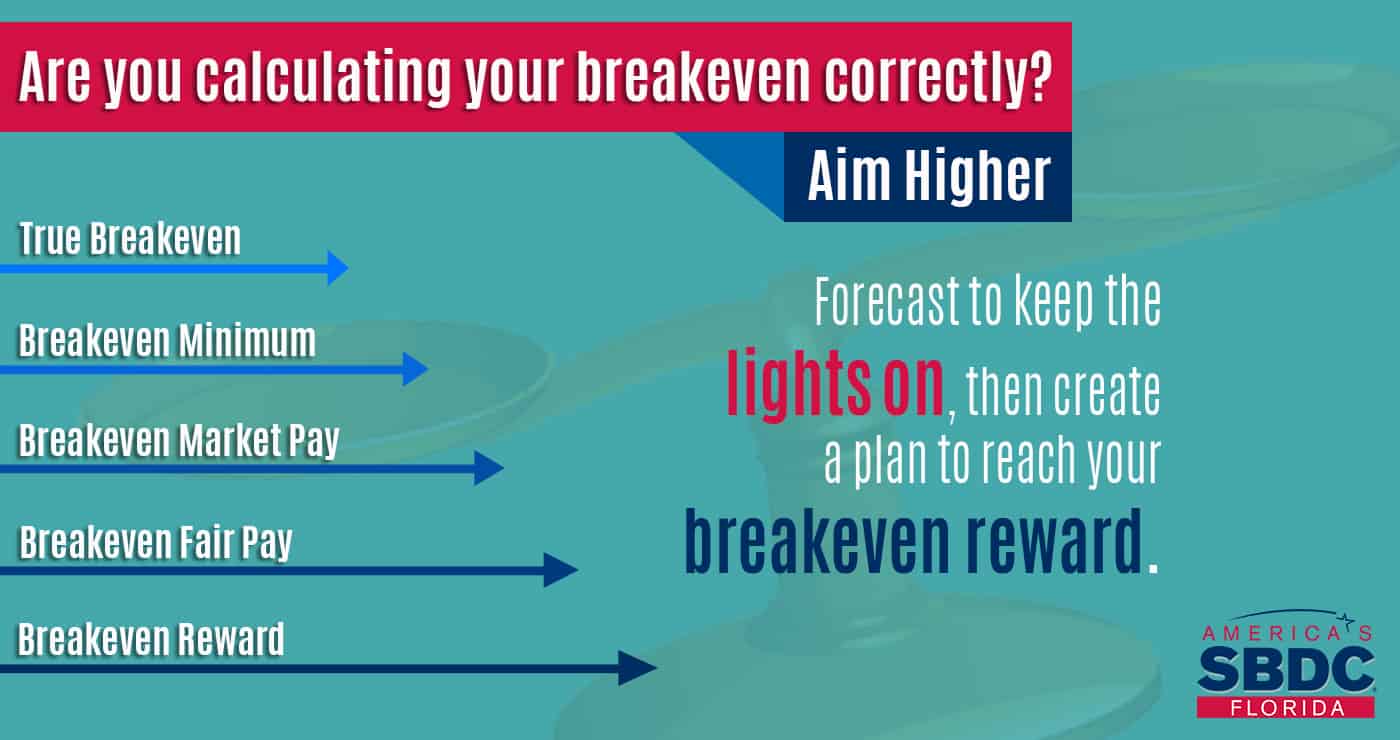

Many businesses create a financial projection to “breakeven.”

It is important to have several breakeven calculations:

- Breakeven Breakeven: This is where you make no money, but the business survives and its bills are paid. For example you need to sell 15 tractors in your farm equipment business to keep the lights on.

15 tractors at $50,000 = $750,000 in revenue and $750,000 in costs. - Breakeven Minimum: This is the minimum for you to survive on.

16 Tractors at $50,000 = $800,000 in revenue, $25,000 for pay. - Breakeven Market Pay: This is the breakeven that pays you the wage you would make working at the same job for someone else.

17 Tractors at $50,000 = $850,000 in revenue, $50,000 for pay. - Breakeven Fair Pay: This is the breakeven that compensates you fairly for the long days, personal risk, increased costs, and wage for your hard work.

18 Tractors at $50,000 = $900,000 in revenue, $75,000 for pay. - Breakeven Reward: This is the breakeven which is why you started the business. To make more money than at your old job. It is why you put everything on the line and you need to be rewarded for that.

25 Tractors ($1.25 million in revenue, $250,000 for pay.

When planning and forecasting your business, consider first that you need to keep the lights on, but you need to have a plan in the first few years to reach your entrepreneurial goals (breakeven reward) or even more.

Ask for more funding than the minimum you need and don’t just breakeven.

[blog_list thumb=”medium” showposts=”1″ post_content=”full” category_in=”331″ disable=”image,meta,more”]