Why a Baseball Coach Might Be Better at Running Your Business Than You

by Bill McKown

March 13, 2017

Imagine for a moment that you are at a baseball game. As the game is about to start, the head coach/manager of your team goes to the umpire and requests the scoreboard to be turned off for the entire game. The manager also requests the umpire not to announce whether a pitch is a ball, strike or if a runner is out. The manager has decided he will simply watch the game until the end, and then ask for the scoreboard to be relit so he can see the final outcome.

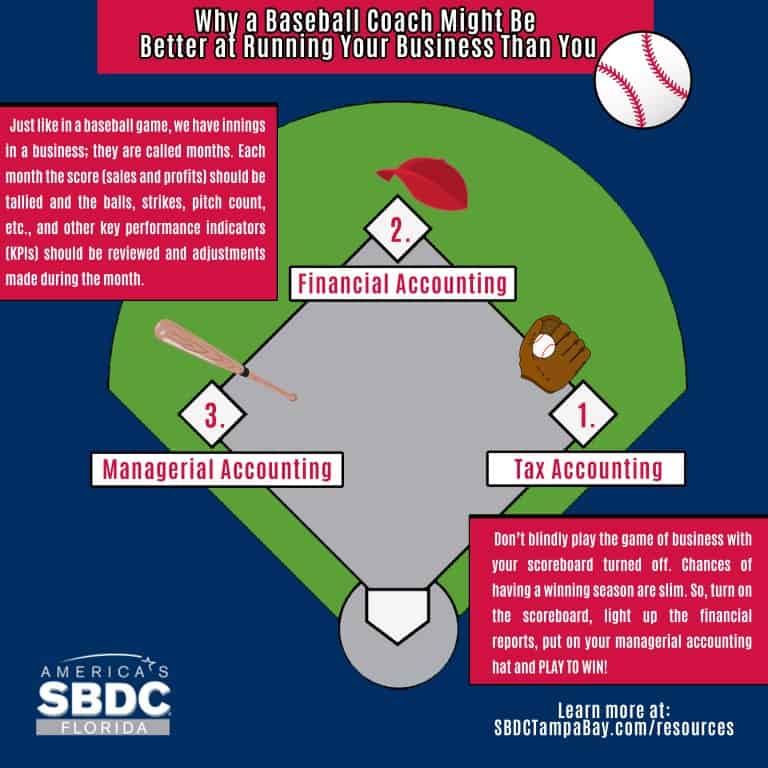

Many small business owners manage their businesses the same way, waiting until the end of the year to see how the business performed. Just like in a baseball game, we have innings in a business; they are called months. Each month the score (sales and profits) should be tallied and the balls, strikes, pitch count, etc., and other key performance indicators (KPIs) should be reviewed and adjustments made during the month.

But here’s how the conversation goes with many small business owners when looking for an accountant:

SB Owner: “Hello Mr./Ms. Accountant. What is the best rate you can give me to do my accounting?”

Accountant: “Do you keep your own books or have an in-house accountant?”

SB Owner: “No.”

Accountant: “Would you like us to provide you with full service monthly bookkeeping and end-of-year tax preparation?”

SB Owner: “Just do my taxes. What is your best price to do that?”

Accountant: “Based on your industry and the size of your business, we can do your taxes for $(fill in the blank).

So where did the business owner go wrong in this conversation? First, let’s understand the three main types of accounting:

- Tax Accounting

In the conversation above, like many small business owners I encounter, there is the belief that accounting fees are an unnecessary expense incurred just to meet the IRS tax regulations. The business transactions of the company are arranged to fit the IRS forms so the tax liability of the business can be computed. In short, all businesses must complete the annual tax accounting. Some small businesses wouldn’t engage an accountant at all if not for the IRS requirement to file annual tax returns.

- Financial Accounting

This is where your banker comes into the picture. At some point the small business owner will likely need financing to support the growth of the business. To loan you money, your banker will ask for certain financial reports. The fundamental reports that will be requested are the Income Statements (aka P&L) and Balance Sheets for specific periods of time, usually the last three years. The banker likes these because the data in the reports is displayed in a standardized format based on Generally Accepted Accounting Principles (GAAP). By simply analyzing the data contained in these reports, the bank can compute profitability, efficiency and leverage ratios to determine the overall health of the business as compared to similar businesses in the same industry. The bank can also determine the capability of the business to service the new debt you are requesting. Informed potential investors or partners will also want to see these reports before committing to a financing deal. Unfortunately, many small business owners forego investing in the resources necessary to get these reports in a timely manner, if at all.

- Managerial Accounting

This is financial accounting on steroids! A good accountant will assist the small business owner in taking the standardized financial accounting reports and creating additional ratios that can help the owner determine KPIs such as sales and/or profits per location, customer, employee, job, truck or selected equipment. Sales levels to reach breakeven or a specific profit goal can be established. As the name implies, this type of accounting helps the owner better manage the firm! It is customized to the small business owner’s business and industry. Only savvy owners understand the power of this type of accounting at their fingertips to make real-time adjustments with daily/weekly KPIs and monthly Income Statements and Balance Sheets.

Too many small business owners think financial management is simply checking the balance in the company checkbook each month and then getting a final report for the year at tax time. Without regular financial reports, the owner is managing blindly or possibly not managing at all.

So, back to the original question, what went wrong in the conversation between the small business owner and the accountant? It should now be obvious that the owner has chosen to blindly play the game of business with their scoreboard turned off. Chances of having a winning season are slim. So, turn on the scoreboard, light up the financial reports, put on your managerial accounting hat and PLAY TO WIN!