My Business Is Profitable – Why Do I Need To Understand Margin and Markup?

Business owners may have a hard time trying to determine their profitability. Javier Marin, a consultant with the Florida SBDC at USF says clients are normally misguided by the balance in their bank account, assuming that as long as there is money in the bank, the business is profitable. “Profitability,” he says, “is not a theoretical concept. Profitability is a quantifiable concept, and as business owners we need to be able to define numerically how profitable our business is.”

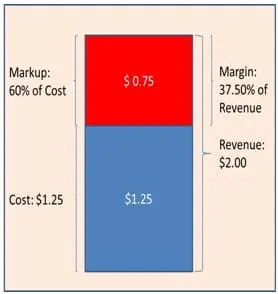

The first step to determine profitability is to know the relevance of a company’s pricing structure in the current market. This can be achieved by understanding markup and margin. Marin emphasizes the importance of understanding your business’ financial statements as a means to knowing how revenues, cost of goods sold, and expenses come together to show whether your business is profitable. He uses the illustration below to describe the difference between markup and margin as they relate to gross profit.

Margin is the gross profit: $0.75 as a percentage of revenue: $2, which is 37.50% in the example.

Marin clarifies that while a business owner uses markup to determine the sales price for products, the financial professionals advising the business would look at the gross profit margin to determine the profitability of the business as a whole.

He maintains that this type of analysis is even more important when your business has several different products or services (lines of business). Can you quantify each line of business to determine its profitability? If the answer is “no,” then here is where he recommends you start:

- Use a bookkeeping product that will allow you to use some type of classification system. It’s called “classes” in QuickBooks.

- Make a list of each of your lines of businesses.

- Categorize (as much as possible) each expense and revenue as they relate to each line of business with your bookkeeping entries.

- Presenting your profit and loss (P&L) report by classes will show your profit for each line of business.

Classifying your P&L will help you determine whether the products or services under each line of business are profitable. In fact, you will understand what actions to take in order to develop a marketing plan to increase profitability even further.

In some cases a business may want to sacrifice profitability on a specific product or service because it opens the door to cross-sell more profitable ones.

Marin cautions that any and all pricing decisions need to be made with full understanding of the actual bottom line for each of these activities or products. “Remember, you can’t make up a loss in volume,” Marin says. “Any decision to sacrifice profitability in a line of business has to be made consciously and in a measurable way. Only then will you know when to discontinue an unprofitable service or product.”

[blog_list thumb=”medium” showposts=”1″ post_content=”full” category_in=”322″ disable=”image,meta,more”]