4 Steps to Improve Business Cash Flow

In spite of the need for the business owner to efficiently manage the assets and liabilities of the business in order grow and improve the cash flow of their firms, few business owners spend the time to determine how efficiently they are managing their assets and liabilities. Even fewer, take the time to amend their internal operating procedures in order to increase the cash flow of the business.

According to Jim Parrish, Growth Acceleration Services Consultant with the Florida SBDC at University of South Florida, “The majority of business owners are too focused on growing sales with too little regard to the cash flow generated or required by those sales.“

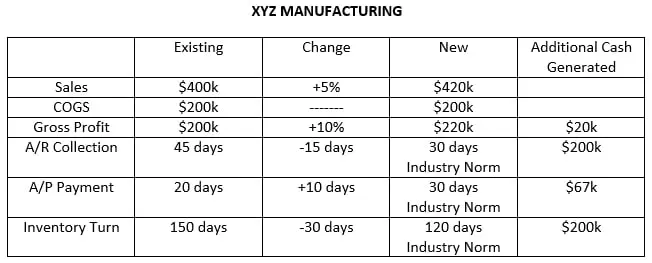

Parrish lists four business activities where small improvements in efficiency can lead to substantial growth in cash. They are:

- Pricing: Even a small increase in price can lead to a substantial increase in revenues and cash flow.

- Collection of Accounts Receivable: Focusing on collecting the money due to you faster reduces the cash needed to grow the business and/or puts more cash into the owner’s pocket.

- Management of Inventory: Moving the inventory faster allows a company to have fewer dollars invested in inventory and still generate sales.

- Paying of Accounts Payable: Some companies actually pay their bills faster than the industry norm, causing them to borrow money from a financial institution and thereby incurring interest costs. This makes them less profitable.

For an example of how even small improvements in these items can have a substantial payoff see the following example:

According to Parrish, “Now is the time of year that companies should review pricing, how efficiently they are collecting their accounts receivable, how efficiently they are managing their Inventory, and are they paying their monitoring their accounts payable consistent with industry norms.

[blog_list thumb=”medium” showposts=”1″ post_content=”full” category_in=”317″ disable=”image,meta,more”]