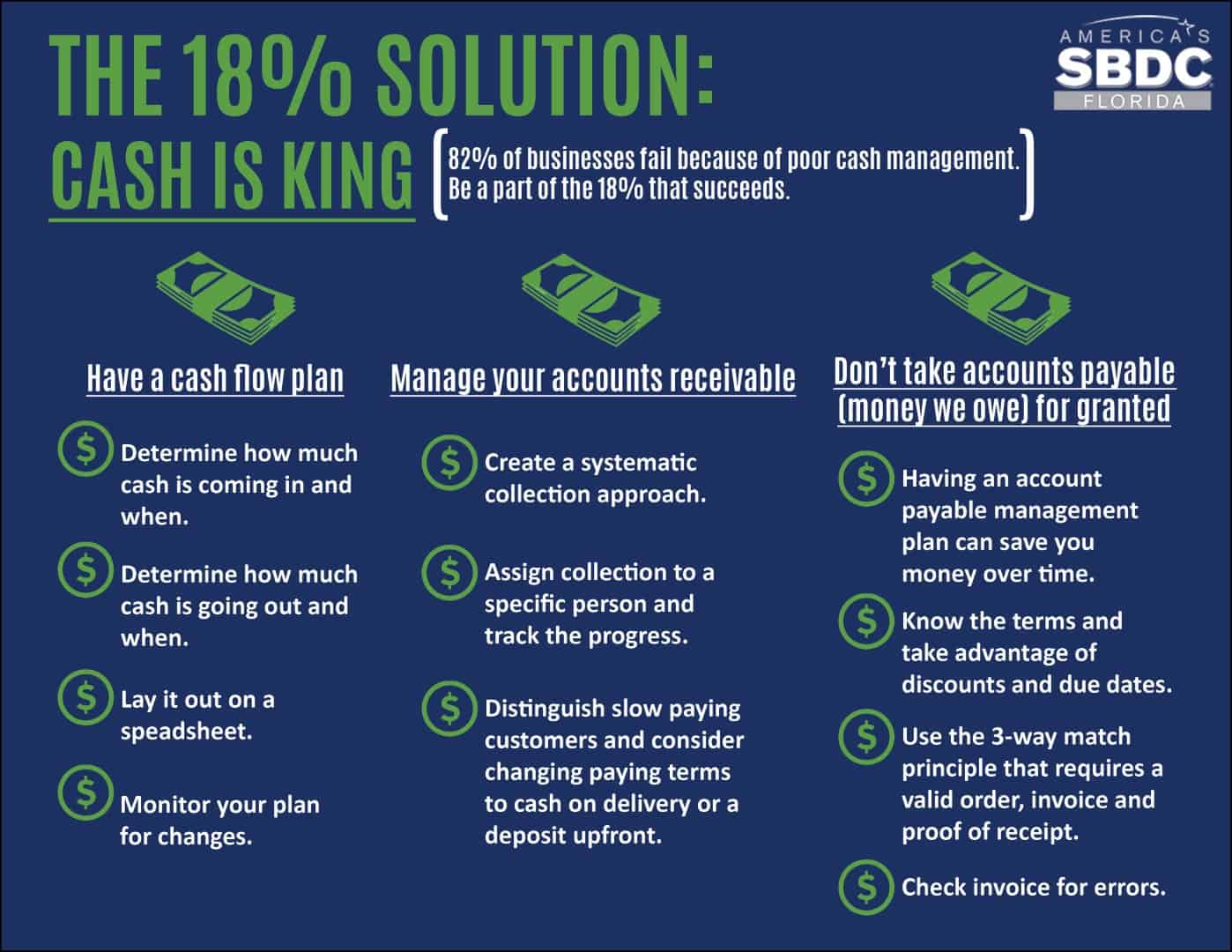

The 18 Percent Solution – Cash is King

Every account on a company’s chart of accounts has a purpose but not all are created equal. Nobody knows for sure who said it first but virtually everyone agrees that cash is king. It always has been and always will be. Cash – it’s the fuel that powers the business engine. Without an adequate supply of cash all businesses will fail, even those whose sales are growing. Startups and small businesses are particularly vulnerable to this because they often don’t have adequate reserves and they don’t understand cash management. A study by US Bank concluded that as many as 82 percent of startups and small businesses fail due to poor cash management. 82 percent! Let that number sink in for a minute. Now that I have your attention you’re probably wondering how do I avoid being part of the 82 percent?

I have recently worked with several businesses who were all struggling in this area and as we discussed their situations I found they all had three things in common which contributed to their problem:

- No cash flow plan

Every small business should have a cash flow plan. It doesn’t have to be complicated. A simple spread sheet will do. Follow these steps and you will have a basic cash flow plan.

- Determine how much cash is coming in and when. Prepare a sales forecast and determine when cash will be received based on that forecast. Looking at your historical payment trends will allow you to determine how long it takes cash to come after a sale has been made.

- Determine how much is going out and when. Looking back over your check register will give you a good idea of the timing of payments going out.

- Once you have the data, lay it out on a spreadsheet. I recommend planning a minimum of a rolling six months, preferably 12 months. This will allow you to see potential cash issues early and take corrective actions before you reach crisis stage.

Make sure to monitor the plan for changes. How often depends on your situation. If cash is tight you may need to monitor your plan daily. As things get better, maybe weekly or monthly will do.

- Poor Accounts Receivable Management

Accounts receivable is the first cousin of cash, but it is often treated like a distant cousin. Collecting money owed to you can be an unpleasant experience. Because of that we often avoid it until it becomes a problem. Don’t fall into that trap. The older receivables are, the harder they will be to collect. Once again some simple steps can make a big difference:

- Establish a systematic collection approach that includes specific actions to be taken on a predefined number of days after a payment is due.

- Assign responsibility for collection to a specific individual and track progress on a regular basis. As with the cash plan, how often depends on your situation, but I recommend weekly to start.

- Determine which customers are historically slow payers and consider changing their terms to cash on delivery or requiring them to make a deposit upfront. If they refuse a change in terms you may have to consider firing them as a customer.

- No Accounts Payable Management

As small business owners we often take accounts payable, which is money we owe, for granted. The bill comes in and we pay it, or we wait until we have the money in our account and we pay it. Sound accounts payable management can save small amounts that over time add up. Do these few things and start counting the savings:

- Check the terms. If the vendor is offering you a discount such as 2 percent if you pay within days consider taking advantage of it. Conversely if the terms are net 30, then pay on day 30 not on day 15.

- Use the three-way match principle that requires you have a valid order, invoice and proof of receipt before the invoice is considered payable.

- Check the invoice for errors. Vendors do make mistakes. Make sure quantities received and unit prices match what was ordered.

Make these part of your businesses culture and be part of the 18 percent that succeeds.

Pablo Arroyo, MBA, CGBP, CME

Arroyo, Consultants, International Consultants 2, International Trade, TampaNASBITE Certified Global Business Professional (CGBP), Florida SBDC at USF, Tampa

Specialties: International Trade, Marketing, Business Planning, Startup Assistance

Pablo Arroyo has 17 years of experience in business development as an owner and business consultant in the public and private sectors. He is a Certified Global Business Professional (CGBP) and a Certified Marketing Executive (CME). He holds a bachelor’s degree in animal science, concentrating on international agriculture and agriculture economics, from the University of Missouri, and an MBA from the University of South Florida in marketing and international business. Arroyo was involved in strategic market expansion for companies from diverse sectors with emphasis on manufacturing, technology, agribusiness, food, tourism, hospitality, entrepreneurship and value-added enterprise development. Originally from Puerto Rico, he is fluent in Spanish and English.