A banker’s way of taking the guesswork out of financial projections

by Brad Owens | November 7, 2018

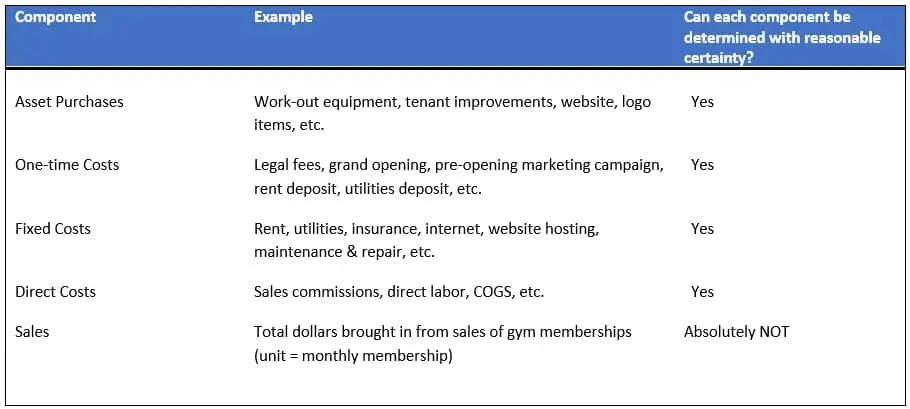

The five essential components of financial projections are:

1) asset purchases

2) one-time costs

3) fixed costs

4) direct costs, and

5) sales.

In order to develop financial projections for a start-up or existing business these five essential components must to be researched, listed and valued. Each of these components can then be calculated with reasonable certainty except one – sales.

For example, let’s assume an entrepreneur is starting a fitness gym:

In order to develop financial projections, start with the four components that can be calculated with reasonable certainty. Only after those four components are researched, listed and valued, should sales calculations begin.

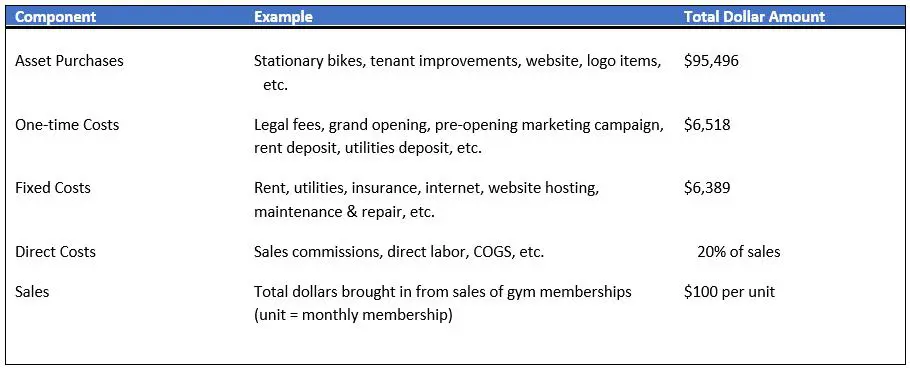

Let’s continue with the start-up fitness gym example:

Now the sales calculations can begin.

The first step is to try and determine a unit that represents the type of sale made at the business. In the case of a fitness gym, many levels of gym membership typically exist. The levels of gym membership are priced based on the number of gym visits allowed per month. The idea is to entice each customer to ultimately buy a full gym membership which allows unlimited visits per month. Therefore, the sales unit for the gym is a $100 unlimited monthly membership. There are two calculations that should now be made:

1) Break-even, and

2) targeted profit.

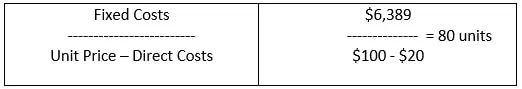

Break-even is calculated as follows:

As illustrated above, in order to achieve break-even the gym must have 80 members paying $100 per month.

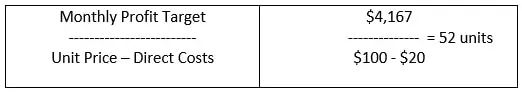

Now let’s assume an annual profit target of $50,000 ($4,167 monthly).

As illustrated above, in order to achieve the targeted level of profit the gym must have an additional 52 members, or 132 total members.

The sales component has now been changed from a guess to a mathematical calculation.

The ultimate question for the entrepreneur, lender, or investor becomes, are the break-even and targeted profit levels of sales units obtainable and how quickly will that occur? The ramp-up period required to obtain break-even will determine how much money will be lost in the interim.

All parties need to ensure there is enough working capital available to cover the losses prior to break-even, plus a cushion in case the ramp-up takes longer than anticipated.

This is a banker’s way of taking the guesswork out of financial projections.

Brad Owens

Business Plans, Consultants, Growth Acceleration Consultants, Owens, TampaFlorida SBDC at USF, Tampa

Specialty: Financial Analysis, Capital Access, Business Plan Financial Forecasts

Brad Owens joined the Florida SBDC at USF in 2017 and provides business owners with no-cost confidential business consulting with an emphasis in financing assistance, utilizing his banking experience of more than 25 years. During his banking career Owens assisted businesses with conventional and SBA lending for their expansion and growth efforts, as well as to help them get started. At Bank of America he was responsible for SBA lending in the Greater Tampa Bay market. In 2005, he was the first inductee into the Florida SBDC Network’s Lenders’ Hall of Fame. He later worked for Fifth Third Bank, Bay Cities Bank and Suncoast Credit Union. His background also includes sales and relationship management experience including formalized commercial credit training. Owens is also a certified Profit Mastery Facilitator.